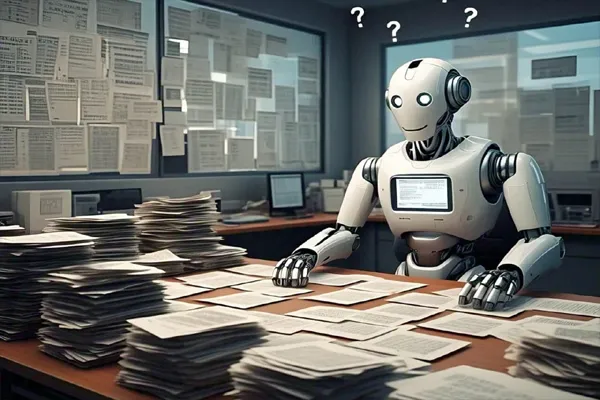

Online filing for companies refers to the process by which companies submit documents, forms, and other required filings to regulatory authorities through an online platform. The online filing process is designed to make compliance with legal requirements more efficient, transparent, and accessible. Below is a general procedure for online filing for companies:

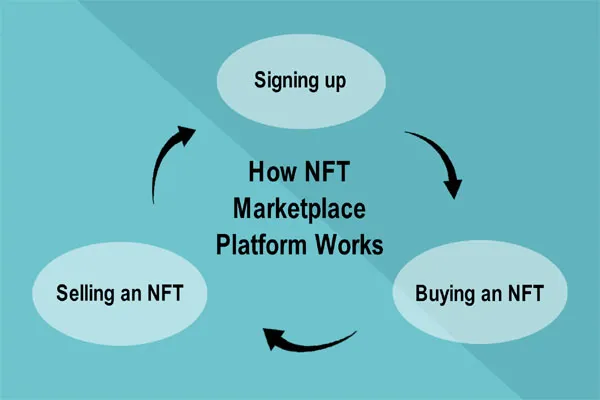

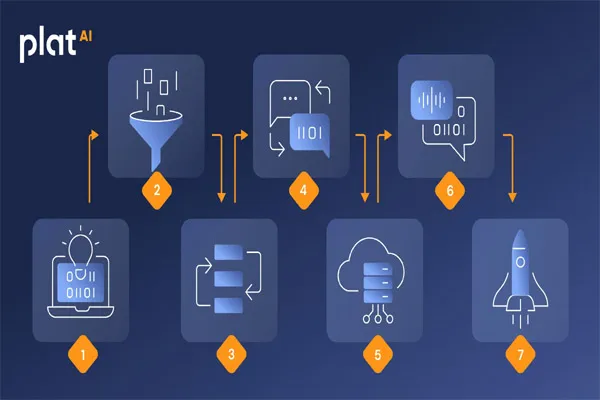

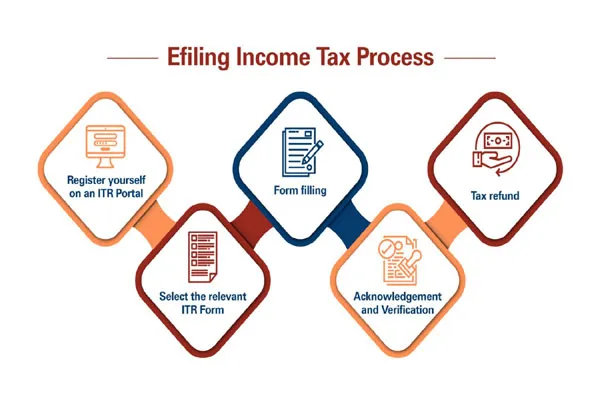

1. Register on the Relevant Portal

- Create an Account: The company must first register on the official website of the regulatory authority (e.g., Ministry of Corporate Affairs (MCA) in India, Companies House in the UK, etc.).

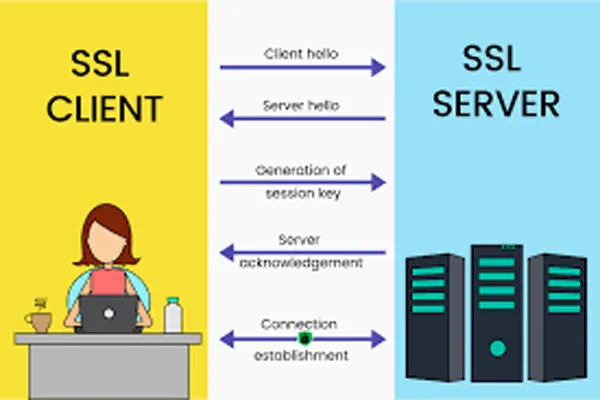

- Obtain Digital Signature Certificate (DSC): The company’s directors or authorized signatories must obtain a valid DSC, which is required to sign electronic documents.

- Get Director Identification Number (DIN): If not already obtained, the directors need to apply for a DIN.

2. Login to the Portal

- Access the Portal: Visit the official online filing platform (e.g., MCA21 portal for Indian companies).

- Login: Use the registered credentials (username and password) to log in to the portal.

3. Select the Relevant Form or Filing

- Determine the Requirement: Based on the type of filing, select the appropriate form from the list of available options. Forms may vary depending on the type of company (private/public), the specific action (e.g., incorporation, annual filing, compliance), or event (e.g., change of address, appointment of directors).

- Common Forms: For example, in India, common forms include Form INC-22 (for the notice of the situation of the registered office), Form AOC-4 (financial statements filing), and Form MGT-7 (annual return).

4. Fill Out the Form

- Provide Details: Complete the online form by filling in the required company details, including the name, registration number, authorized capital, business activities, financial details, and director details.

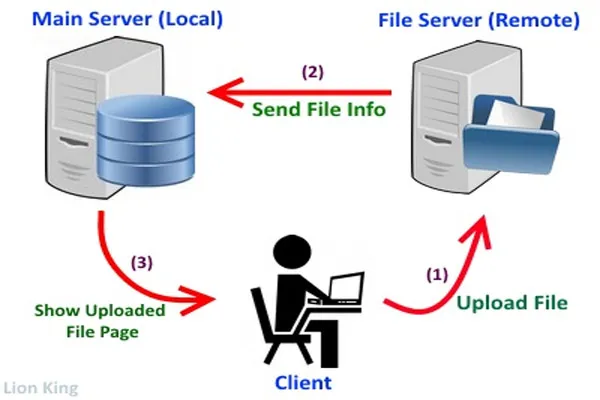

- Attach Supporting Documents: Upload any necessary documents (e.g., balance sheet, memorandum of association, articles of association, resolution, etc.) as required for the filing.

5. Verification and Certification

- Verify Details: After filling out the form, review all the entered information and attached documents for accuracy.

- Digital Signature: The form needs to be signed digitally using the DSC of the authorized person (usually a director or company secretary).

6. Payment of Fees

- Calculate Filing Fees: Based on the form and type of filing, calculate the applicable filing fees. The fees are generally calculated on the basis of the company’s authorized capital, the type of service, and the filing deadline.

- Make Payment: Pay the required fee online using various payment methods such as credit card, debit card, net banking, etc.

7. Submit the Filing

- Submit the Form: Once the form is correctly filled out, verified, and signed, submit it online through the portal.

- Acknowledgement Receipt: Upon successful submission, an acknowledgment receipt or confirmation number will be generated. This receipt serves as proof of filing.

8. Track the Filing Status

- Check Status: After submission, the company can track the status of its filing through the portal. The status may be updated as “Under Process,” “Approved,” or “Rejected.”

- Respond to Queries: If the regulatory authority finds any discrepancies or requires additional information, the company will receive a notice. The company must respond promptly by submitting additional documents or making corrections to the filing.

9. Approval or Rejection

- Approval: Once the filing is processed and approved, the company will receive an approval notice or certificate, depending on the filing type (e.g., incorporation certificate, annual return certificate).

- Rejection: If the filing is rejected due to errors or omissions, the company will need to rectify the issues and resubmit the form.

10. Retain Records

- Download and Save the Acknowledgment: It is important to download and keep the acknowledgment receipt or approval certificate for future reference and compliance.

- Maintain Document Records: Keep digital or physical copies of all filed documents and forms for legal and audit purposes.